Alexander Johann Eser

Monetary Anarchy

The Separation of Money and State

Audiobook

Monetary Anarchy

The Separation of Money and State

Table of Contents

Dedicated to those who pursue truth, regardless of the consequences, and who are unafraid of what they might find.

Preface

Occasionally in life, we may find ourselves compelled to undertake tasks that aren’t necessarily our top preference, but we recognize that if we abstain from them, no one else will, leaving the world in a worse state. Such is my feeling about this book. My desire to impart knowledge about the prospect of monetary anarchism – the separation of money from government authority – and its benefits for humanity stems more from a moral responsibility than a bid to present myself as an economic authority. Moreover our education system has difficulty embracing ideas that defy traditional thinking and reach beyond specific disciplines. If your work deviates from the consensus, it will not be recognized with citations. Lacking citations, your reputation within academics will not progress, and subsequently, you will be unable to obtain a high-ranking role within academic institutions. This, in consequence, impacts your financial security as you struggle to find employment in the academic field. As such, numerous academics feel forced to endorse mainstream beliefs for the sake of self- preservation, without considering the motivations they are promoting.

Is there any book, article, or publication that promotes the separation of money creation from government control, advocates for society’s adoption of decentralized currency, and bears “anarchy” in its title that appears to be mainstream economics? Certainly not. That’s the reason this book exists, authored by a tech entrepreneur with no ambitions of being the next confused economist. Instead, my goal is to appeal to discerning, logical, and fundamental thinkers who are unencumbered by intellectual dishonesty in order to protect their careers. In the spirit of Picasso, I must admit that I embrace the idea that good artists copy while great artists steal. Accordingly, throughout the text, you may encounter some of my own unique ideas mixed with those of prominent libertarians like Ludwig von Mises, Murray Rothbard, Hans-Hermann Hoppe, David Friedman, and Jörg Guido Hülsmann (among others). Also it is essential to recognize the influence of Nassim Nicholas Taleb’s work on my thinking, and in his honor, I must acknowledge my unwillingness to adhere to academic standards or provide proper attribution. When unsure, presume that my points are not original. Additionally, I will torment the minds of experts by oversimplifying complex subjects without elaboration, trusting readers to research arguments that challenge their reasoning. It is far more crucial for me to stimulate the thoughts of curious readers rather than conform to any academic norms.

As for the MBA business professionals who wish to impress their coworkers or peers, the TL;DR version of the book is quite straightforward. So, even if you don’t read the entire book, please do one favor for humanity: spread the word!

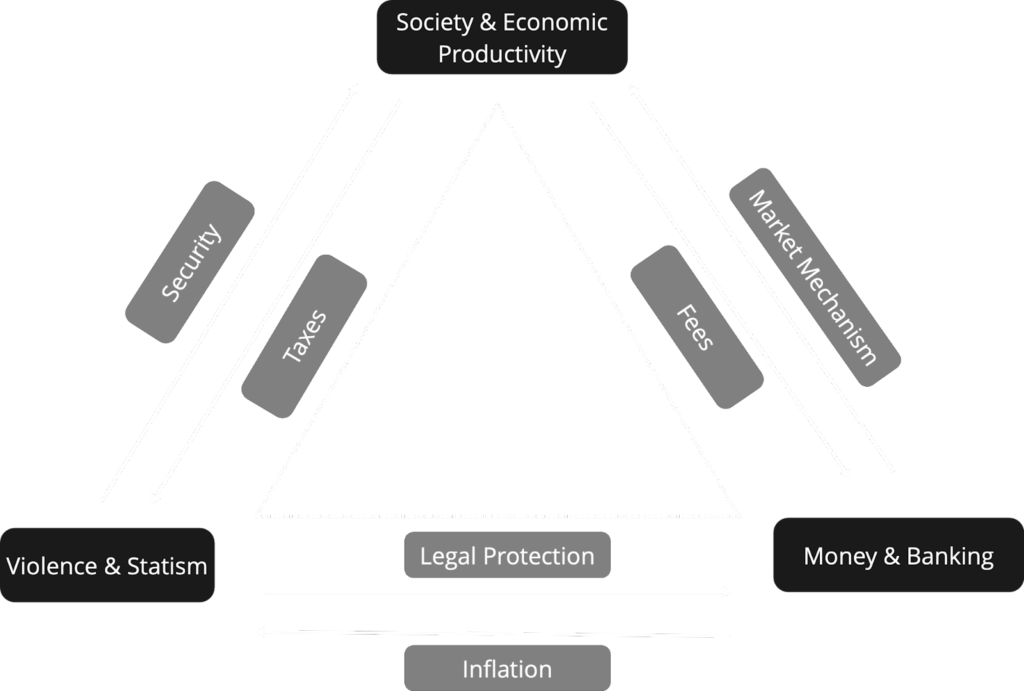

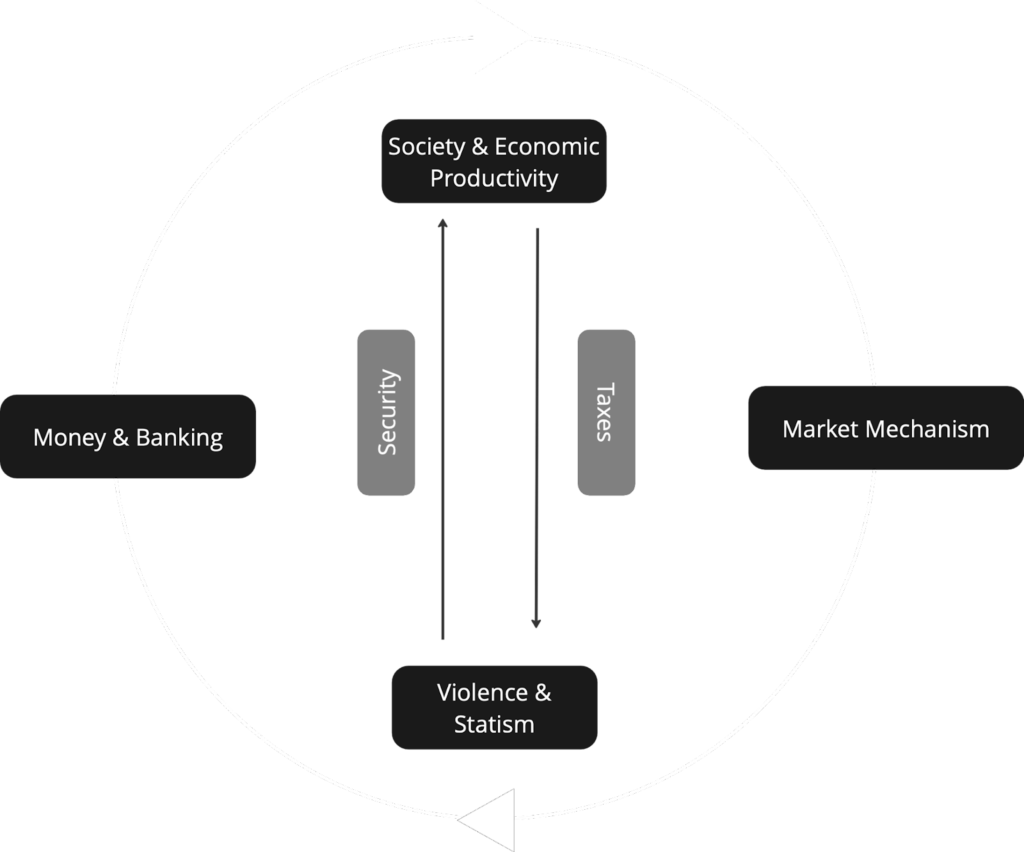

TL;DR: Money serves as the lifeblood of society, transmitting essential information about the scarcity of goods through the market mechanism. However, active interference in the money market by nation-states distorts price signals, resulting in a massive misallocation of resources and giving an unfair advantage to a select group of political insiders at the expense of society. This scheme is enforced by the state apparatus through its monopoly on violence, as it feeds on its subjects like a parasite without consent. States impose a regime of economic terror on humanity through taxation and the unethical act of inflation, exerting their monopoly on money production. The separation of money production from the state offers humanity the opportunity to restore virtue, promote peace, and advance humanitarian progress. For the first time in history, these possibilities have become achievable through the emergence of the trustless Bitcoin network and the implications illuminated by its technical features.

Introduction

There is a growing unease in our world, a sense that something is not quite right. It is hard to pinpoint the exact source of this feeling, as it manifests in various ways: the gradual erosion of family values, increasing social inequalities, the disappearing middle class, and the need for multiple jobs to provide for one’s family. Furthermore mental health struggles and depression are common, quality time with loved ones is scarce, young people grapple with understanding their roles in society, and access to housing, healthcare, and education feels more and more like a privilege. The concept of a fulfilling life feels like a relic of the past, replaced by a dehumanizing present that treats us as cogs in a machine. This societal imbalance causes distress for many, leading to a rise in extreme viewpoints on both ends of the political spectrum. People search for easy answers, dividing themselves into allies and adversaries – surely, there must be someone to blame for our troubles, right? Unfortunately, pointing fingers at those we disagree with won’t solve our problems. Rather than resorting to blame, we should collectively reflect on why our world looks the way it does, and explore the potential steps we can take to change our course. But for many, this task may seem overwhelming. Where should one start? Which questions should be asked? Whose information can be trusted? The subsequent book embodies the zenith of my personal quest to understand the world.

The spark that inspired me to reflect on the current state of our society was my initial encounter with Bitcoin. I dismissed it at first, assuming it was just another get-rich-quick scam and a tool for criminals. As it turns out, I couldn’t have been more wrong. In my opinion, Bitcoin holds the keys to solving the vast majority of humanity’s challenges. While this might seem like an outlandish claim, it’s important to consider that those who have dedicated a significant amount of time (about 1,000 hours or more) to studying Bitcoin often arrive at the same conclusion. Fundamentally, Bitcoin offers a means of organizing ourselves as a society that is free from corruption, coercion, and centralization. It ensures that everyone plays by the same rules and that these rules cannot be manipulated for personal gain. Adopting this fair coordination method would allow our civilization to reach new heights by negating the need to grapple with the consequences of our existing, compromised system. To achieve this, it is crucial for us to acknowledge the flaws in our current way of organizing society and to actively work towards rectifying the challenges we face. How can we ensure a fair, violence-free system that provides a strong economic foundation for our collective future? Although addressing our societal problems may be challenging, and these may not be the thoughts that preoccupy most people on a typical Saturday afternoon, it is crucial that we dedicate time to examining our current social condition instead of blindly conforming to established norms.

When discussing “coordination mechanisms” or “societal organization,” what I am essentially referring to is “money.” Money is the cornerstone of every society, permeating every aspect of our lives. It functions as information, language, expression, power, representation of time, and most importantly, a human invention. What is unnatural is the use of money as a tool for widespread devastation through the manipulation of our financial institutions and the economic oppression of a large segment of the population by monetizing debt. This is orchestrated by political elites under the guise of statism, allegedly for societal improvement. To break this cycle, we should adopt the Bitcoin network as our preferred means of separating government from monetary creation, much like political authority was once detached from religious institutions through statism centuries ago.

The outcome of this separation is monetary anarchy, which, on the surface, might seem like a contemporary spin on the French Revolution that leads to bloodshed on Wall Street. However, the truth is quite contrary. While the word “anarchy” often carries negative connotations, it doesn’t have to. Anarchy essentially means the absence of governance or leadership, which in turn implies the absence of manipulation, corruption, and coercion. In an unregulated and interference-free market, all participants engage anarchically. For example, consider dating: No one can dictate the rules governing relationships. Jane has sovereignty over her own body, and John has no control over it without violating her individual property rights to herself. If the dating market were anything other than completely anarchic, society will strongly protest.

Dating benefits from being easily perceived as a market that must be free from external influence and can only function morally in a state of anarchy. Money, on the other hand, is much more complex for most people, making it difficult to grasp why monetary anarchy benefits society as a whole. So, even if you find it challenging to keep up with subsequent chapters, remember that adopting monetary anarchy is the only intellectually defensible moral stance we can take to create a better future, much like the only morally defensible position for the dating market is the anarchy of choice (the “why” will be addressed later).

To clarify and comprehend the advantages of monetary anarchy, we will first explore the origin of money production, then examine the emergence of money monopolies under the pretense of statism and the reduction of individual freedoms. Following that, I will discuss the evolution of states from aristocracy to monarchy to democracy and why they are neither necessary nor morally justifiable. Next, I will propose an alternative system, specifically anarcho-capitalism, and ultimately envision a new era for humanity, one that is liberated from the shackles of economic apprehension and powered by a decentralized monetary framework. However, before delving into a discussion about society as a whole, we must first address another topic: How do we determine our knowledge?

The Origin of Knowledge

Examining the origins of knowledge acquisition may seem like an unusual starting point when considering a society built on monetary anarchy. However, it is crucial for our deliberations to comprehend where definitive knowledge originates and whether there is even such a thing as definite knowledge. Why? Because all arguments we present to persuade others of our viewpoint will inevitably lead to discussions about how we know that our approach is accurate. Unsurprisingly, we have to go against mainstream thinking on this matter. Science labels all knowledge that is not derived from observable experiments as “pseudoscience.” We are taught in academic institutions that we need to run statistical tests and crunch numbers to definitively prove something as true or false. This methodology, known as “empiricism,” is the prevalent approach for being regarded seriously within academia. According to our educational system, this suggests that all knowledge stems from experience and cannot be obtained in any other manner, barring a few exceptions. However, is this entirely accurate? Gaining knowledge through experience implies that if something cannot be observed, it must be untrue or insignificant. For instance, one might contend that because of Bitcoin’s significant price fluctuations, it cannot function as a currency. Is this evaluation precise, or does a parallel universe exist alongside ours where Bitcoin is the primary means of monetary exchange?

To resolve this conflict, let’s examine the mathematical equation “2+2=5.” Remarkably, this simple statement has the ability to disturb our rational minds. What could be the reason? It’s because we’ve learned that 2+2=4, and if we went around claiming that 2+2 amounts to 5, we might find ourselves in a psychiatric facility. However, imagine if we altered all calculators in New York City so that they display the sum of 2+2 as 5 rather than 4. We would still feel uncomfortable and recognize that something is not right. Why is that? We have just witnessed the observed reality that 2+2=5, not 4, as demonstrated by the significant statistical evidence from thousands of calculators. Surely, this must be accurate?

It turns out, it’s not. Mathematical principles are universal and not limited by location. Identical reasoning is valid in various places and times. Even a child who is homeschooled and taught by their parents that 2 plus 2 equals 5 would soon discover that this is false. The only factor capable of altering math is perception. Two plus two can indeed equal two, rather than four.

How is this possible? Through the modification of inputs: observing two lions plus two gazelles yields four animals in total, yet there remain only two lions.

In essence, mathematics demonstrates a fundamental truth that all entities must comply with. The understanding of mathematics (distinct from the knowledge produced by mathematics) is referred to as “a priori knowledge.” This knowledge is acquired without relation to reality. Even in the absence of the surrounding world, mathematics and logic remain valid. The phrases “a priori” and “a posteriori” primarily serve to indicate the basis for acquiring certain knowledge. A specific proposition is considered “a priori” if it can be understood without relying on any experience except for the process of learning the language in which the proposition is conveyed. Conversely, a proposition that is “a posteriori” is learned through experience, or as mentioned earlier, via empiricism.

To put it in simpler terms, there exist two realities: one that we recognize as truth by definition or logic, and another that we discern as truth through observation. Embracing this differentiation is vital for comprehending the arguments that I will introduce later on. To emphasize this concept, here are a few examples:

| A priori: knowledge through logic | A posteriori: knowledge through observation |

|---|---|

| My father’s brother is my uncle. | My father’s brother has black hair. |

| Blue is a color. | The ocean is blue. |

| 2 + 2 = 4. | 2 quarts of any liquid added to 2 more quarts of any liquid = 4 quarts of liquid. |

| All bachelors are unmarried males. | All bachelors in the U.S. are taxed at a different rate from married men. |

| Happiness is an intrinsic good. | Happiness is the result of doing what you like. |

Instead of just accepting the statement that John is the uncle of his brother’s son, we can use logical reasoning to verify its accuracy. However, we cannot simply assume that John has black hair as a fact, as he can also have brown or blonde hair. To verify his hair color, we must observe it. Additionally, the idea that blue is not a color is impossible, so we can confirm this without observation. Nonetheless, it is not guaranteed that all oceans are blue. So where does definite knowledge come from?

Common sense suggests that it is likely that neither methodology is entirely accurate. Some knowledge cannot be obtained through logic alone, and not all knowledge arises from empiricism (observation). Nonetheless, as previously discussed, certain aspects of knowledge can unquestionably be deemed accurate via either of the two methods. The disagreement between rationalism (understanding through reasoning) and empiricism (comprehension via observation) has its origins in the time of ancient Greek thinkers and features prominent advocates for both viewpoints.

Immanuel Kant was the pioneering philosopher who sought to reconcile these methodologies. He introduced the concept of “transcendental idealism” as his solution to the problem. This seemingly complex idea can be rephrased as the notion that our minds actively contribute to shaping our experience of the world. According to Kant, we can’t know things as they exist independently but can only understand them as they appear to us. Consequently, our perception of the world isn’t solely based on external reality but is also affected by our cognitive processes, including concepts, categories, and modes of reasoning. Kant posited that the world we perceive is a blend of sensory information and the mental framework employed to interpret this data. This framework consists of innate, a priori concepts such as space, time, causality, and substance, which are embedded within our mind’s structure. These concepts enable us to arrange our experiences into meaningful patterns and comprehend the world around us. Kant contended that empiricists are misguided if they believe empiricism is the only valid method for attaining knowledge because they insist that it’s impossible to transcend experience. Rationalists are also mistaken because they claim it’s feasible to surpass experience through theoretical reason. For Kant, both approaches were valid and complementary.

Similar to Kant, readers might prefer a balanced stance between these two extremes. Regrettably, mainstream economic theory doesn’t share this view and dismisses all knowledge derived from “a priori” reasoning instead of observation. If you feel that no knowledge can emerge from logic concerning economics and monetary theory, then it’s time to set this book aside. In the end, all arguments I can present for or against a decentralized monetary system will lead to a debate about the legitimacy of “a priori knowledge” versus “a posteriori knowledge.

However, if you allow logic the opportunity to transform our observed reality, the first task is to identify a theoretical framework for economics. This framework should encompass a series of principles that remain accurate, no matter the reality we perceive, much like mathematical equations. Fortunately, there is a consensus amongst academics regarding the origin of this economic logic; all evidence points to Ludwig von Mises and his economic methodology known as Praxeology. His straightforward yet brilliant idea is that human beings possess limited resources, or “means,” but they have infinite wants and desires. In order to fulfill these wants and desires, individuals must make choices about how to use their resources. As long as people have finite resources and infinite desires, they will consistently make choices and take actions to satisfy their needs. This understanding (formally referred to as an axiom) must be accurate because it cannot be disproven without either conceding its truth or engaging in self- contradiction. This is because anyone attempting to refute it would have to utilize limited resources, such as time and mental effort, to do so. This would be classified as an action. As a result, the “action axiom” denier would either contradict themselves or be compelled to acknowledge the legitimacy of the action idea. This implies that economic knowledge can, in fact, be obtained through logic, and we do not need to witness it firsthand to accept it as true.

Reevaluate the earlier statement and ponder on it. Humans have desires and need to act to fulfill those desires. If we want to disprove the statement, we must personally act since we have the desire to refute it. Therefore, we cannot disprove it without creating a contradiction. As a result, we can make assertions about human actions before we even execute them. All human actions combined makeup economics, which means we can make assertions about economics that are accurate (“a priori knowledge”) without the requirement to observe them (“empiricism”). We can determine how the world should be instead of how we experience it. We might refer to such a world as utopia because we may never witness it come to fruition, but we can endeavor to progress towards that economic framework to build a more prosperous future. In other words, a set of economic rules based on deductive reasoning enables us to identify facts about our world without needing to prove them right, as they are universally true. The striking difference between these facts and the current state of the world we inhabit may be startling, but that does not render them any less accurate.

Regrettably, state intervention and academic theories have imposed an alternative perspective on society, combining empirical observation and economics in an effort to incorporate data and measurements into monetary theory. As a result, they try to create fixed relations between variables where none exist. This method fails to take into account the subjective nature of value and the complexity of human behavior. For example, they may argue that reducing taxes by a certain percentage will lead to a predictable increase in economic growth, suggesting that this pattern will be consistent across different nations and time periods. However, this argument is flawed since human actions are influenced by individual values and are therefore unique, making it impossible to establish fixed relationships. Economic events are unpredictable and cannot be repeated, unlike controlled scientific experiments.

In reality, the market is a complex mechanism that collects and processes information, generating outcomes based on the data it assesses. Fixed relationships do not exist in this context, and interfering with the market process essentially implies that a small group of decision-makers holds greater knowledge than the cumulative choices made by all market participants. This mindset exemplifies human hubris. Unfortunately, mankind has a penchant for arrogance. We consider ourselves superior to nature (e.g., we have the ability to fly), so what is the harm in assuming we can supersede the inner workings of the market? Yet, we never truly transcend the laws of nature. Airplanes still function under the principles of physics, and any attempt to ignore them leads to disastrous consequences for those who dare. The same cannot be said for the repercussions of ignoring fundamental economic truths derived from logical deduction.

Economists who determine the financial destiny of nations are seldom held responsible for the accuracy of their forecasts. As a result, it is often easier to make a crowd-pleasing decision rather than one that is solidly grounded in reason.

Why do mainstream economists, politicians, and academics seem so quick to dismiss the potential for a priori knowledge about money and economics? To grasp the reasons behind their behavior, we need to scrutinize their individual incentives. This fundamental fact allows us to understand why the field of economics is hesitant to be guided by logic. If a set of infallible rules is derived from logic, there is no room for mistakes. The equation of 2+2 only has one answer. However, the moment empiricism comes into play, countless solutions for any issue arise. If the current outcome of your hypothesis testing does not meet your preferences or comply with your political beliefs, altering the hypothesis or variables becomes easy. In practical terms, this means that governments and their appointed economists can consistently find reasons to interfere in the market process under the façade of economic empiricism. Essentially, governments have developed an excuse to behave as they wish without being constrained by logic.

As a result, our monetary and political systems are founded on deceit. The deception is so widespread that grasping its extent is difficult. Yet, the book presented here aims to achieve precisely that. The following text is an appeal to readers: either become convinced that economic truth based on logic matters or acknowledge that the system we live in and its representatives intentionally disregard economic rationality. With an open mind, common sense, and reasoning, readers are invited to join as I investigate the formation of an alternate monetary reality that allows humanity to thrive.

The A-B-C of Money

Natural Money

Previously, I mentioned that money serves as the thread that connects humanity and enables coordination. When our currency becomes distorted, human actions are disrupted and misdirected. Monetary value acts as the beacon around which humans operate. Prices inform us what our fellow humans find valuable and what they do not. Which items should we produce more of, and which ones should we abandon? As such, our journey to comprehend the world begins with an examination of money. What exactly is money, where does it originate, and why does it have value? Why is the state the sole institution authorized to create it?

In seeking answers to these questions, we can alternatively ponder the reverse: What would a world without money look like? In the absence of money, we have to trade or barter items we produce for those we desire. This process introduces a plethora of challenges. First, we face the issue of coincidental encounters or double coincidences, where we must locate someone who wants to exchange their goods simultaneously with our own. This may seem trivial, but what if the items you wish to trade are perishable, such as apples? Another aspect to consider is the problem of measuring value. How many bushels of hay equate to the worth of a cow? How can one trade a portion of a cow for an apple? Extending this idea, we may even question the necessity of trading at all. Why can’t everyone be self-reliant and attend to their own needs?

The straightforward response is that productivity increases through the division of labor. People generate a greater output collectively than individually. Even for someone who excels in all tasks, dividing labor is a logical approach. If the market values apples twice as much as bananas and Harry is a more skilled apple and banana farmer than John, should Harry cultivate both fruits? The answer is no. Because Harry possesses a competitive edge in growing the more popular fruit (apples), he should concentrate solely on cultivating apples and exchange them for bananas in the market. By focusing on apple production, he will be better off than if he attempts to grow both fruits. Conversely, John can forgo apple farming and produce something (bananas) the market desires. However, how can Harry and John trade their products if they cannot find anyone willing to exchange their goods at the right time?

A medium of exchange is needed to resolve the situation. To overcome the issues related to direct exchange, everyone must agree on an item that can be universally traded for all other goods through indirect exchange. This universally exchangeable item must possess several qualities to meet the demands of its users. It should be durable, non-perishable, easily transportable, divisible, fungible (i.e., adhere to a uniform standard), and have a limited supply to maintain value due to scarcity. Moreover, it should be effortlessly identifiable and widely accepted by all market participants. In essence, it must be the most marketable commodity – the one that everyone desires. An item that meets these specifications becomes natural money, satisfying the market’s need for a store of value, unit of account, and medium of exchange.

Can a new form of money simply be introduced into the market, or does the market need to choose a preferred product to serve as a medium of exchange? To address this question, consider the scenario of providing dollar bills to our prehistoric ancestors. Would they begin exchanging meat and berries for these dollar bills? They would not. For an item to be accepted as money, it must develop organically within the marketplace and possess value beyond its potential monetary worth. Simply put, it is extremely risky for someone to trade their goods for a medium of exchange without knowing if it could be resold in the market. Therefore, the monetary item must be marketable and have inherent value. To prehistoric humans, dollar bills hold no intrinsic worth. Therefore, to become money, everyone must trust that others will accept these dollar bills as a medium of exchange. This suggests that the most marketable commodity is the prime contender among all goods to become money. Being able to consistently trade my goods for this natural money-contender, I can start measuring my items using that currency’s unit of account, eventually leading to money as we know it.

Historically, humans have utilized a vast range of commodities as money: cigarettes, shells, gemstones, cattle, cotton, copper, silver, gold, and numerous other items. If communities worldwide can independently choose their preferred currency, various currency options would likely emerge because different commodities best embody the desired attributes of money in different regions. In some areas, gold may not be easily obtainable, leading to a more accessible product taking the role of local currency. This is not to say that gold lacks value in such communities. A free-market system communicates the worth of goods through pricing, which results in the coexistence of multiple currencies within the same society. Copper, silver, and gold would have exchange rates, enabling small transactions with copper, medium ones with silver, and larger ones with gold according to their current market values. The non-coercive monetary selection process, originating from individual choices, enables the most marketable commodity to rise to the top of the money hierarchy. The selection’s outcome is a posteriori knowledge, as logically predicting the winner is unfeasible, making money an intrinsically social and human product.

Credit Money

How is it that we have paper currency today, or arguably not even physical currency, but digital cash? How can something with no inherent value in the market function as money? To better comprehend this occurrence, let’s envision a woman named Heidi who wishes to sell a perishable item such as meat to Lisa. She slaughters one of her chickens and sets the meat aside for Lisa to collect. Lisa, who lives a day’s journey away from Heidi, realizes upon arriving at Heidi’s home that she has forgotten her gold coins. What should Heidi do? Discard the meat reserved for Lisa? Both parties would be worse off. Lisa has expended time and energy in getting to Heidi’s house and is famished, while Heidi has already killed one of her chickens and wants compensation. The solution is an IOU (I Owe You) agreement, essentially a piece of paper that Lisa can issue, promising that anyone who redeems the IOU will receive gold coins. She hands the IOU to Heidi. The next time they meet, Heidi will redeem her IOU, and Lisa will pay her in gold coins. In this instance, we refer to credit money, which relies on the crucial assumption that Heidi trusts Lisa to repay her, based on their shared history. If Lisa has a poor reputation for not repaying her IOUs, no market participant will accept an exchange based on credit.

But what if Heidi moves away the following day and never encounters Lisa again? She can attempt to sell the IOU to her neighbor, Harriet. Since Lisa pays anyone who redeems the IOU with gold coins, it holds inherent value, even if the IOU is a mere piece of paper. The critical aspect here is that the piece of paper is supported by gold coins. Therefore, paper and digital currency can only ever possess value if they are supported by something of value in the market. Additionally, as it must be backed, this type of credit money can never be as prevalent as natural money, as its supply (claims on natural money) is constrained by the supply of natural money while also carrying inherent risks. Unlike cash exchange, which is the direct settlement of liabilities between two parties, the redemption of an IOU can only occur later. The holder of the IOU bears the risk of the issuer’s bankruptcy, and in case of default, the debt collector is left with nothing. As a result, credit money can only naturally expand if it is supported by natural money, and IOU issuers are credible. We have already determined that money as a commodity in the free market is in constant competition with other commodities, with the most marketable commodity winning the battle for the monetary crown. If unsupported paper currency were to compete in such a market against natural money, it is crowded out.

Money Production

In practical terms, how does money come into being in a free market environment? Precious metals, particularly gold, evolve as the most marketable commodities that possess all the characteristics required to be deemed exceptional money. To better satisfy these criteria, it is necessary to convert precious metals into coins, enhancing their divisibility and portability. Carrying around large amounts of gold and silver is not feasible for everyday use, and according to the division of labor concept, it is logical that several entrepreneurs join the money production industry to create enough coins for the local economy to operate efficiently. It is likely that those who mint money would not even be responsible for extracting gold from the earth; instead, each stage of the money production value chain is its own business. Similar to how a clothing store has customers, money minters also have clients, adhering to market rules by providing the finest possible products. If consumers were dissatisfied with the product, as might happen if the money minter attempted to defraud them by selling coins at face value but using inferior metals, that specific monetary production entrepreneur will go out of business, with only the most reputable minters remaining in the marketplace.

A potential criticism of this market mechanism is that an economy may require more money to grow than minters can provide. This is indeed true, but as previously mentioned, it is improbable that only one type of coin would serve as currency. If the market demands more gold coins but gold has run out and no new coins can be produced, the value of existing gold coins rises. This, in turn, enhances gold’s purchasing power and the exchange rate of gold to silver, subsequently increasing the demand for silver coins to make up for the shortage of gold on the market. If silver is also depleted, demand will transition to copper and so forth. The market then replaces the need for superior money with a slightly lower-quality money that is more readily available while valuing the scarcer currency higher. This substitution of demand continues until the market’s needs are met.

Is it not possible for the minters to exploit their unique position in society and produce vast amounts of money for their own gain? As long as minters are honest and do not debase the coins they are selling, the market will keep them in check due to the law of diminishing returns which prevents them from blatantly exploiting their control over the money supply. The law of diminishing returns constrains the production of coins in all free markets, indicating that each subsequent coin produced holds less value for the producer compared to the one before it. In the same way as any other enterprise, money minters must make sensible decisions when dealing with scarce resources. Therefore, they will always allocate their capital to initiatives offering the highest returns. These returns are determined by the individual preferences of all market participants and their needs for various goods. As a result, the creation of money within a free-market society is fully integrated into the division of labor phenomenon and cannot exceed the boundaries established by the market process. The market will consistently stay one step ahead of the money minter, ensuring they are kept in check.

Inflation

What happens if the money entrepreneurs were not honest though and tried to exploit their clientele by rendering the law of diminishing returns obsolete?

As a money minter motivated by greed, I can either surreptitiously sell my clients debased coins that contain less valuable metal than they assume or I can use my fraudulent coins to directly buy products in the market. In both cases returns on money produced do not diminish and the money supply increases beyond its natural state. In such a scenario we speak of “inflation” or an inflated money supply. Originating from the Latin term “inflare,” inflation fundamentally shrinks the savings of individuals possessing currency because when there is more money available in the market, its value decreases assuming the quantity of goods remains consistent.

Accordingly, for a short period at the risk of being exposed, money producers can defraud the market. It is crucial to recognize the dishonest and deceitful intent behind the inflation process. The money producer is well aware of their deeds and plans to sell the produced coins at a higher market value than the precious metal content warrants. Merchants who trade their goods for counterfeit money obtain less value for their products than originally agreed upon. Nefarious minters can take advantage of their clients through inflation, which can readily be identified as morally reprehensible.

However, since coins are sold by weight (which also makes the origin of currency names evident as, for instance, “British Pound”), clients can check the weight of the coins to avoid being duped. Consequently, as soon as the market realizes that there is more money in circulation than expected, prices rise to account for the increased money supply, and the fraudster will go out of business. The corresponding adjustment period is known as the Cantillon effect, during which resources are misallocated, and the market becomes distorted. It should be plainly evident, however, through simple logic, that the money supply must be neutral – meaning that an increase or decrease in the money supply has no real influence on the local economy because prices will adapt as quickly as possible to the new situation. A change in the amount of money available does not imply that our available resources have changed. If there is ten times more money, everything will merely cost ten times more than it did before, rather than there suddenly being ten times more products available.

Yet, our current economic principles, mainly advocated by John Maynard Keynes and the neoclassical school of economics, assert that the concept of monetary neutrality is flawed, and that fluctuations in the money supply have real, short-term consequences for the economy. This idea supports the belief that we can manipulate the economy at will, with the ability to regulate production and unemployment in the short term. These short-term adjustments are then believed to influence long-term economic prospects. Consequently, the economy can be operated much like a machine at the discretion of the institution controlling the money supply. In the present day, this is a central bank, but in the hypothetical scenario mentioned earlier, it could also be a monopoly held by the money minters. One must wonder how much opium one needs to consume to genuinely believe this to be true. While constructing an economic system that exploits its constituents may be the observable reality we see today, it can never be the fundamental truth of monetary theory.

Let’s revisit our narrative about money minters and the reasons why it is challenging to nefariously inflate the supply of commodity money. In a free society with no entry barriers to the money production market, anyone can start issuing their own currency or try counterfeiting a successful minter’s coins by using less or no precious metals. However, these counterfeit coins can be easily detected, as most minters engrave distinct patterns. Coins can also be cut or melted to verify their legitimacy. Although minters and counterfeiters can potentially deceive users of commodity money, it remains a challenging endeavor since the value certification is directly stamped onto the precious metal.

However, what happens when the underlying commodity value is removed from the certificate that attests to the value’s availability, as in the case of Lisa issuing an IOU to Heidi? Lisa can provide an IOU without possessing the necessary coin to repay Heidi. While such an action may resemble a morally corrupt crime, it becomes more difficult to detect. As a result, identifying fraudulent credit money transactions as inflationary thievery is more complicated.

Taking into account safety and practicality, particularly in the past, carrying large bags of gold and silver coins might not have been the wisest choice for an individual. Usually, when there is discomfort, profit follows. As a result, markets evolve and provide a solution to alleviate this discomfort. Savvy business people can establish money storage facilities and provide custodial services to the market. One can pay a set fee to have their coins safeguarded by the security services of the money storage facility. In return, the businessperson issues a certificate indicating that it can be redeemed for a specific amount of coin. Clients can then trade these certificates amongst themselves, streamlining the market process and further reducing friction in commerce. The exchange of certificates functions as long as everyone involved trusts the money storage facilities to keep their coins secure and not use them for personal benefit. Unfortunately, throughout history, the temptation to misuse the property rights of the rightful coin owners has always been too strong to resist.

Just as coin minters can stamp an incorrect certificate on their coins, money storage facility operators can inflate the money supply by issuing certificates without actually possessing the corresponding precious metals in storage. Alternatively, they can use the valuable metals entrusted to them to make purchases directly in the markets. In either case, the money warehouses lack sufficient precious metal holdings to cover all the liabilities they have towards their clients. As a result, they have not full reserves, but fractional reserves. If all clients decide to redeem their money certificates at the same time, it leads to a situation called a bank run. This means that the facilities where money is stored will not be able to pay back all their clients. It is important to note that money warehouse operators can already run a profitable business by providing security and custody services to the market, but excessive greed turns them into criminals.

It doesn’t take long for money warehouse operators to realize that money can generate more money and that they can benefit from participating in the profitable banking industry. They can offer loans and receive interest payments in addition to the principal amount, representing their profit. At its core, this practice is not inherently wrong. Any market participant can lend out their savings as a loan and earn interest. If money storage facility operators lend out their profits earned through their custody service business, there would be no ethical issue at hand. However, banking and lending become an immoral act of theft when money storage facility owners issue loans using their custody service clients’ money, which was never theirs to lend, and then profit from the interest payments.

Consider the following scenario: your best friend goes on vacation for a month and entrusts you with the keys to her house so you can care for her plants and ensure everything stays in order. In response, you put her apartment on Airbnb and profit from renting it out. If you rent out your own apartment, there is no ethical issue. However, renting out someone else’s property without their consent and profiting from the rental fee is an immoral act of theft.

Financial services can often appear as complex as rocket science, and financial professionals have every incentive to let their business appear complex so the average citizen does not understand what is going on. This is illustrated by the fact that banks, when providing loans using their own funds, should issue individual IOU certificates in addition to certificates representing the commodity money they store for clients. By using identical certificates for both custodial services and loans, the money warehouse banker combines two separate service lines without the consent of their customers. Consequently, market participants need to find a trustworthy money warehouse operator if they want to keep their savings safeguarded from fraud. It is important to note that there is nothing inherently wrong with fractional reserve banking. If the money warehouse operator also wants to function as a banker, they can communicate this to their clientele. They may advertise a 90% reserve ratio, enabling them to lend 10% of their holdings and profit from interest payments. This profit can then be used to reduce custody fees, benefiting both parties. However, experience has shown that banks rarely communicate the nature of their fractional reserve operations to the users who finance the business. From the beginning, bankers are eager to mix certificates and make it difficult for outsiders to understand what is happening, which can lead to confusion and fraudulent practices.

In a twist of irony, the offense of undisclosed fractional reserve banking could have developed as a free-market reaction to another crime. It is evident that a warehouse containing commodity money is a tempting target for unscrupulous individuals looking to obtain a large amount of value with minimal effort. While burglars, raiders, and foreign invaders might come to mind, their impact is negligible compared to the ultimate violator of private property: the state. To fund their war endeavors, kings and governments often turned to banks for support, forcing monetary depositories to find ways to safeguard their client deposits from government reach. Ironically, they accomplished this by loaning out the very funds they were entrusted to hold securely.

Nonetheless, inflation, defined as theft through confusion and intention, can never be viewed as a net gain for humanity in any economic scenario. When the money supply inflates, the value of money diminishes, and its purchasing power decreases. It is akin to money having an expiry date or shelf life. If the money supply inflates, the money you have earned loses its value, and you can no longer purchase as many goods as before. Waiting too long may even render your money worthless. Is it morally justifiable for you to receive currency as compensation for your labor when this currency has an intrinsic shelf life, and you cannot control when you can use it without suffering financial losses? This doesn’t seem like a fair deal.

In the 21st century, those who control money production can openly announce a crime on television without any reaction, or worse, convince people that being robbed has a positive aspect. This is a clear indication of how effective those in charge of money production and banking have been at obfuscating their tactics over the centuries. Therefore, it is essential to educate ourselves on these matters and understand how banks and other financial institutions operate to protect our assets and make informed decisions.

The Monopolization of Money

Outlawing the Free Money Market

It is clear that in a free market, commodity money can be compromised by dishonest individuals through forgery or acquisition, but this does not mean it can be entirely disenfranchised from the market. Competition ensures the integrity of money production, with minters, money storage facilities, and banks that deceive their customers being pushed out of business by bankruptcy and bank runs. Therefore, while decentralized money production may have problems in individual cases, it does not suffer overall from fraud. As long as consumers have choices, money production is protected from total malfeasance. However, the situation changes when one entity monopolizes the market, exploiting its position by forcing all market participants to endure their transgressions. As the desire to expand wealth without limits appears to be the ultimate goal, competition for financial supremacy has existed since the beginning of human civilization.

Let us acknowledge that states and their monopoly on money production exist in our world, despite the fact that we will later question their purpose and challenge their existence. A government has two primary sources of revenue that it can use to sustain itself. Firstly, it can tax its citizens, but this is a double-edged sword that must be used judiciously. As the government is given legitimacy by its citizens, it must be careful not to antagonize them. Therefore, governments prefer a more discreet method of financing, namely inflation or counterfeiting. When the government creates new money, it profits because not all prices in the economy immediately adjust to the new money supply. Consequently, states have a strong interest in monopolizing the money production market to become the sole beneficiaries of the proceeds from inflation.

However, how can a government monopolize the money market? As they are endorsed by the public, governments can not secretly infringe upon their citizens, similar to how money warehouse operators evolved into bankers. Instead, they need to persuade their constituents through effective propaganda that they hold the authority to engage in widespread theft, and anyone who challenges this is hostile toward the government and unfaithful to their nation. The primary strategy of the government is to outcompete the coinage market through legislation, which is then enforced by the public executive branch. The state essentially gives itself exclusive privileges, which in turn designate it as the only entity authorized to produce money and dictate what money truly is. This set of rights also guarantees that forgery is a crime when committed by others, but not when the state itself engages in counterfeiting. Utilizing these laws, the government can fuel its propaganda campaign and convince the public that it is within its rights as a hegemon to take from them. Thus, by eliminating choices for its citizens, the state lays the groundwork for institutionalized exploitation of its position.

So, what do these individual laws accomplish in promoting inflation? Let’s examine how someone might establish a complex inflation machine to generate profit on a large scale at the expense of society.

Law I – Only the state can counterfeit: First, let’s examine the law that allows only the state to create counterfeit money without consequences. For instance, if a gold coin claims to hold one ounce of gold but contains only half as much gold or none at all, it is still considered worth one ounce of gold by the government. However, this law only applies to government- produced money. If any other party were to create money privately and use it in the economy, they would face severe punishment. While this law may appear unfair, it does potentially offer a significant convenience benefit for all market participants. As every coin with the same imprint is theoretically valued equally, whether debased or not, people supposedly no longer need to confirm its contents and authenticity. However, this is not even true in a closed economy. The market isn’t easily deceived, and just because a law states all coins are equal, debased or not, doesn’t make them so. As mentioned earlier, in a natural economy, various types of money emerge (such as gold for large transactions, silver for medium-sized ones, and copper for daily life), and people treat them accordingly. Thus, less debased coins are valued higher, and it’s probable that they would be removed from circulation as people use them for savings, wealth protection, or sale in foreign markets if possible. Therefore, the right to counterfeit alone doesn’t enable inflationary efforts.

Law II – Only the state can create money: Second, let’s explore the law that allows only the state to create money, thereby eliminating competition. In a hypothetical scenario where a government bans gold as a form of money and decrees that copper coins are the official currency, this would likely impact the demand for these metals in the economy. However, the government can only dictate what is officially considered money; it cannot prevent market participants from evaluating that money based on its intrinsic value. If citizens notice coin debasement or realize that certificates aren’t backed by sufficient commodity value, they may reject the government-issued money or redeem it for the underlying commodity. This means that a monopoly on money production alone doesn’t necessarily lead to continuous revenue from inflation. While a government can potentially gain some short-term benefits from such a monopoly, it may not be sustainable in the long run.

Law III – The state forces its subjects to accept its coin: This brings us to the final option of turning any monetary asset into legal tender as a last resort for the state to enable inflationary theft. Legal tender laws nullify private contracts and require market participants to accept payment in any currency labeled as legal tender. If a loan is issued in gold units and the debtor agrees to repay the lender in gold ounces upon the due date, but silver becomes legal tender in the meantime, the creditor must also accept silver as debt repayment. Naturally, no conflict arises because gold will establish a natural exchange rate for silver in the market. Yet, if the ruling party sets a fixed exchange rate for silver and gold below the natural rate, the debtor can take advantage of the creditor and repay less value than initially agreed upon. Suppose the market rate for one ounce of gold is 20 ounces of silver, but the government sets the exchange rate at 15 ounces instead of 20. In this case, the creditor must accept a smaller payment to settle the loan, as gold is undervalued compared to silver.

Accordingly, gold will leave circulation because each gold coin spent represents an undervalued asset. Instead, it will be sold in foreign markets to obtain the complete natural value of 20 ounces of silver. As a result, the silver supply inflates beyond the natural amount demanded, and the gold supply quickly vanishes. The temporary reduction in the overall money supply causes a sharp drop in the price level and harms businesses, as debtors won’t be able to pay their debts with lower cash flows. Thus, the local economy suffers from a wave of bankruptcies. During the readjustment process, the government can profit by selling gold at higher rates abroad and paying off its debts at lower costs. As a result, the ability to declare any asset as legal tender enables the government to expand its inflationary measures.

In conclusion, the exclusive authority to define money and to lawfully create counterfeit currency does not enable the government to secure a steady income through inflation because citizens might still assess the value of commodity money and refuse it if necessary. It is only when the government implements legal tender regulations, compelling its constituents to accept devalued money as payment, that it can transform inflation into a source of revenue.

In the end, the government’s sinister plan may not appear impressive due to its simplicity rather than complexity. However, maybe that is what makes it so brilliant? By creating laws that protect themselves from any weaknesses in their monopolistic tactics and exerting these laws through violence, society gradually forgets how these regulations were initially validated and begins to accept them as they are. As a result, our currency is now referred to as fiat money, symbolizing money by government decree. While the government’s tactic of hiding in plain sight might be malicious, it is undeniably astute. At the very least, nobody can claim they were uninformed!

Nonetheless, while tricking the public might be beneficial, if it leads to a significantly weakened economy and a reduced possibility for prosperity through commerce, the long-term credibility of the state is at risk since it relies on its citizens’ goodwill. Therefore, declaring an inferior monetary commodity as legal tender not only results in economic hardship but also carries additional drawbacks, as it poses an economic danger to business people. Merchants and traders tend to stay away from countries where the government is known to devalue the local currency, as there is always a chance of receiving lesser value for their goods than expected in the market. Moreover, governments prone to devaluation have a more challenging time securing more credit and ultimately have to acknowledge that taxes will be paid with the devalued currency. As a result, governments are encouraged to secretly devalue their commodity money.

Fractional Reserve Banking to Cloak Theft

If governments struggle with inflation that is evident to those affected, why not make it more difficult for the public to understand the situation? One approach is for the government to collect all commodity money by force and then introduce fractional monetary certificates that are not backed by the full value of the commodity. With no way to see the number of certificates in circulation, the government could increase the supply as it wishes, as long as it maintains its ability to exchange certificates for commodity money. This approach requires a fractional reserve banking system to support the plan of hiding the inflationary process in plain sight. But why would the public accept these certificates in the first place? Let’s find out.

As previously mentioned, when an inferior or devalued currency is made legal tender, the economy undergoes deflation because the inaccurately valued coins are removed from circulation, leading to a monetary gap. Subsequently, prices must fall such that the entire economy can be measured in the remaining money supply. At this point, governments can step in and fill the gap with fractional paper money certificates supported by the legal tender currency. This idea will be readily accepted by the public, allowing prices to gradually climb again as the money supply expands and economic discomfort diminishes. It’s crucial to acknowledge that the government doesn’t have to fear the complete redemption of all certificates at once, as long as it exhibits restraint in debasement. Therefore, individual requests for precious metal redemptions can be met. The government’s only responsibility is to ensure that the average citizen believes everything is under control, meaning not everybody wants to exchange their paper money certificates for tangible commodities all at once. Ultimately, by eliminating the public’s ability to directly observe the amount of legal tender currency in circulation, the government gains control over inflation.

To better comprehend this scenario, let’s imagine Sieglandia, a country with 1000 kilograms of gold, 500 kilograms of silver, and 1500 kilograms of copper circulating as one-ounce coins. The prices of all goods in Sieglandia are determined by the availability of these coins. Now, the government has made gold coins the only legal currency in Sieglandia and introduces exchange rates for gold that are lower than the natural rate. As a result, all prices in the economy must adjust due to the exit of silver and copper coins from the market, as they become undervalued. With fewer coins available to price all goods, the only solution is to lower the price of individual goods. Reduced prices lead to economic difficulties because of miscalculations. If the government collects all 1000 kilograms of gold coins and issues paper money certificates instead, no one can verify the number of paper claims on gold, allowing the government to print more certificates than it has gold for redemption. This is only possible when the underlying commodity is separated from the money certificate. If gold is exchanged directly, all prices must represent the presence of gold; however, prices do not need to reflect gold if no one can directly observe the amount of available gold. This plan succeeds as long as the public believes there is a sufficient amount of gold for redemption.

Thus, governments can bypass the negative consequences of making commodity-based currency legal tender by implementing a layer of abstraction through money certificates and establishing them as legal tender. In this manner, the money supply doesn’t shrink, preventing a deflationary price spiral and ensuring the domestic economy remains stable. International trade can still use commodity money if needed, creditors aren’t deceived, allowing the government to continue accruing debt, and future tax revenues aren’t reduced.

It becomes clear why the complex partnership between the government and banks has developed into the formidable force it is today. Banking is safeguarded by the government through legal tender laws, and the government acquires an additional source of revenue. From this point on, the objective is to accumulate wealth through inflationary thievery, limited only by the public’s faith in certificate redeemability. Although this final hurdle prevents limitless riches, the government and banks have made significant progress and devised a strategy that allows them to expand their illicit operations.

However, the fractional reserve banking system presents its own challenges, which the Machiavellian government has to address. It appears that banks are poorly motivated and receive rewards for taking on greater risks instead of operating a stable business. Since a bank profits from inflation, it is encouraged to issue more credit and decrease its reserves as much as possible. It is crucial to note that even a prudent banker must keep pace with his ambitious counterparts to maintain his market share. Banks understand that they can only fail if all depositors simultaneously want to redeem their money certificates, and they recognize that other banks are also heavily leveraged and lack sufficient reserves to redeem all paper claims. As a result, banks deduce that if a bank run were to happen on one bank, the banking industry likely supports the individual bank and bail it out to avoid a domino effect. If one bank collapses and sets off a series of bankruptcies, the business clients of other banks may also fail as their customers have just gone bankrupt. If these other clients begin redeeming their money certificates due to crisis concerns, the entire system risks collapse.

As a result, every bank strives to assume more risk to increase profits and maintain their position in the market share race, knowing that they will probably be bailed out in the end. This mutual reliance and coordination requirement has led to the cartelization of the banking industry, with a select few players influencing the financial world. For the government, it is logical to act as a kingmaker, as seen in the earlier case of choosing which commodity to use as a monetary asset, and grant one bank the unique privilege of money production, collaborating with this bank to establish its inflation scheme. This gave rise to the idea of a central bank. The money certificates issued by the central bank will outperform all other money certificates from other banks, and the market will consolidate around the central bank. Strangely enough, the monopoly status and legal protection by the government put the central bank at a disadvantage in comparison to other commercial banks, despite being the sole entity allowed to produce money. Why? Because all other banks depend on the cash it produces, it must maintain larger reserves than commercial banks and cannot issue money certificates as liberally.

Paper Money to the Moon

We have now arrived at a stage where the government has set up a central bank to manage its inflation strategies and eliminated the use of underlying commodities, like precious metals, in daily transactions with paper currency. As a result, governments can systematically and institutionally exploit this to their advantage. The system may falter if too many people try to exchange their certificates for precious metals due to increasing uncertainties, such as war, but this risk can be lessened by suspending payments – meaning, refusing to swap paper money for commodity money. If a commercial fractional reserve bank were to cease payments in a free market, depositors consider the bank insolvent and avoid it in the future. However, what happens when a central bank stops payments? Does it face the same fate? It is clear that governments strive to prevent the repercussions of their currency’s collapse at all costs, like being barred from international trade or experiencing a substantial decrease in their ability to accumulate public debt, while still wanting to inflate the money supply. To solve this dilemma, we must ask: How can a government prevent reaching the point where it has to suspend payments in the first place?

One might expect a complicated web of deceit, but the simple answer lies in adding another layer of deception to the monetary pyramid. What if there were no precious metals to be exchanged for the paper money certificates? What if the paper in your hand truly held value? In this situation, the government can “print” money endlessly, without needing to sustain the illusion of redeemability in precious metals, since the production costs of paper money are virtually nonexistent compared to the labor needed for refining precious metals. Usually, under the cover of national emergencies like war efforts, governments can “temporarily” suspend the conversion of commodities to money certificates.

However, as is commonly known, nothing is more enduring than a temporary government measure. It is important to note that the holders of national monetary certificates – that is, the citizens – have no means of avoiding their fate. Their realistic options include either initiating a revolution to overthrow the government, or withdrawing financial support by determining that paper without commodity backing isn’t money and consequently using an alternative commodity as a monetary asset. Given that both options take time to execute and the country is typically amidst a crisis, as previously mentioned, citizens are more inclined to simply accept their new reality. The unfortunate reality is that in the short term, it doesn’t matter to them whether or not they accept paper bills at face value to keep the party going and avoid further difficulties. As the connection between money certificates and their underlying commodities has already been severed, it is simpler to participate in a collective delusion of attributing value to paper, rather than facing a significant loss in savings or initiating a revolution. Thus, if everyone believes that paper is money, it becomes a socioeconomic phenomenon. As a result, paper money holds value because the state claims it does and society accepts this difficult truth.

Nonetheless, the long-term consequences experienced by citizens are far more serious. The desire to do and consume more than limited resources allow is not only present in individuals, but also evident in the nature of the state. Personally, we access debt to augment our means to achieve desired outcomes. However, our capacity to borrow money depends on the assets we can provide as collateral to secure a loan. This formula does not apply as readily to the state. When money is simply printed on paper, and the government has no reason to fear rebellion when it inflates the money supply because redeemability is irrelevant, then the government has, in a very literal sense, unrestricted authority to finance all its ventures without the approval of its constituents.

These ventures are nevertheless constrained in scope. The government can print money, but this does not magically create weapons and tanks. The economy still possesses the same resources as before. Considering this, if the government were to endlessly increase the money supply, the only result is a rise in prices. If prices increase too quickly, it can lead to hyperinflation – that is, if money loses its purchasing power daily, or even hourly. Imagine a scenario where a loaf of bread costs $5 in the morning and $20 in the evening at the same store. In such cases, economic reasoning is no longer applicable, and society is likely to cease utilizing the monetary asset until stability is restored.

As a result, although governments can use inflation to fund some of their needs, they cannot be overly aggressive in pursuing this approach if they want to maintain their dominant status. For this reason, they must also employ debt as a means to finance their expenditures. Thus, another constraint emerges in the form of competition among nations, which hampers the sinister plot of granting unlimited monetary authority to any single state. If there were only one country in existence, all market players would have no choice but to accept its monetary manipulation. However, even in our hypothetical scenario, other countries must be acknowledged, and as a result, investors have the choice to invest their money in the public debt of different nations. If a government is notorious for aggressively inflating or for having currency that is only as valuable as the paper it’s printed on, then it struggles to raise capital. This implies that national governments must operate their inflationary strategies within certain acceptable limits in order to attract investments. The observant reader might question why anyone lends money to a government known for perpetrating such theft. The apparent answer is accurate in this instance: because the investor stands to benefit from it as well. As discussed earlier, if a government increases the money supply, prices within the economy will rise, causing assets such as real estate and company stocks to also appreciate in value. Who owns the majority of these assets? Primarily investors, rather than the average citizen. Consequently, society must contend with rising living costs, but usually, their wages do not increase as rapidly as asset price inflation. So, even though investors are aware that governments inflate the money supply and profit from it, they also stand to gain as they become relatively wealthier compared to the rest of society, ultimately improving their overall situation.

In conclusion, we have discovered that governments have an insatiable desire for revenue, which can be fulfilled either by imposing higher taxes on citizens or through inflation. Increasing taxes is unfavorable and undermines the state’s legitimacy; therefore, the hidden force of inflation has always been the favored method of theft. Natural money sets a boundary on rampant inflation, as the money certificate is intrinsically linked to the underlying commodity. However, once the certificate is separated from its represented value, the door is opened for fractional reserve banking to further escalate the inflationary scheme. Governments and banks can use inflation as a limitless source of revenue only after the implementation of legal tender laws. These laws provide the authority to create money and control its supply, allowing them to generate profits without boundaries. The adoption of paper currency, which possesses no intrinsic value, allows the government to assert its control over money creation and dodge any accountability to its people when making decisions. If you are reading this book and living in a democratic country, have you ever questioned why you cannot vote for the individual who heads the central bank? This person arguably holds the most critical position in any economic system and can instantly eradicate your financial assets. Why, then, is such an influential role not subject to democratic election?

Statism

If governments and states are such burdens on society, why do we allow them to persist? If you acknowledge that you are being robbed daily, you make every effort to alter this circumstance. Nonetheless, under the guise of patriotism and the continuous effort to stay afloat amid rising inflation, we fail to question the fundamental structure of our society. Instead, we passively accept the existing conditions, much like heroin addicts who prioritize their impulses over logic. Humanity never takes a moment to step back and reflect upon the reality we observe.

It’s all too easy to dismiss any opposition to the state because it shapes the world around us and constantly reinforces its necessity through our everyday experiences. If the state is responsible for all infrastructure, streets, laws, police, and various other services, it’s difficult to envision a different way of life. However, just because our present world is governed by statism, it doesn’t imply that it has to stay that way. Keep in mind, there is a difference between knowledge gained through observation (our current reality) and knowledge obtained through reasoning (possible reality). To dismiss knowledge derived from reason, as our current economic system does, is intellectually dishonest. If all men mistreated women on a regular basis, does that mean that the reality for these women is the only feasible existence, simply because it’s confirmed by daily observation? Clearly, the answer is no. Therefore, let us explore the genesis of statism, assess its consequences, and evaluate the path that states embark upon, potentially leading us towards a grim future.

The Emergence of Nation States

Even in a hypothetical state of nature, where individuals exist without the constraints of law and order, humans are restricted by the limited availability of resources, leading to the necessity of making choices. We cannot perform multiple tasks at once, and two people cannot occupy the exact same space simultaneously. If John consumes the last chocolate piece in the refrigerator, Jane cannot have it as well, despite her desire for it. Consequently, conflicts arise between human beings when our intended actions clash.

One might assume that in such a situation, the law of the jungle prevails, with the physically stronger individual holding a monopoly on violence and, therefore, imposing their will. However, let us debunk this misconception for a moment. What do you think occurs if the stronger person consistently imposes their will on weaker individuals? Others soon learn to avoid that person, resulting in their isolation. While subjugating others is advantageous in the short term, it becomes burdensome if it’s required in every interaction. As a result, violence becomes costly for the one who exerts it. Moreover, if the strong individual is ostracized from trade and society, their life will be considerably more challenging than if they lived harmoniously with others. Hence, predatory behavior, manifested in cannibalism, slavery, and crime, may provide short-term benefits but is unsustainable in the long run. Humanity quickly realizes that cooperation is more advantageous than violence.

If not through violence, how should conflicts be resolved? To address this issue, individuals recognize the necessity for an arbitrator: a person or institution that resolves disputes based on universally accepted laws for those seeking to live within that society. Similar to the intrinsic value of natural commodity money, an arbitrator cannot be chosen by force. Society must perceive the arbitrator as deserving of their role through the respect of their peers. This respect may be earned through exceptional skill, wealth, or military accomplishments. The arbitrator must possess a natural authority that the majority of society accepts, enabling them to have the final say in dispute resolution. If the arbitrator were in their position solely by force, they are no different than the initial strongman and are expelled from society. Additionally, abuse of power results in their removal by the public. Though imagining such a society requires a fair amount of faith, consider the dynamics in kindergarten and elementary school. While adults usually established some rules, children naturally developed their social hierarchy and norms without a single child acting as the playground’s dictator. Since children’s behavior is based more on instinct than elaborate thought, their actions closely resemble a natural societal state without centrally imposed power.

Consequently, the most natural form of human society is an aristocracy, where its leaders are chosen based on merit and validated by public respect. In this set up, aristocratic nobles act as mediators, and their judgments can be disputed in the courts overseen by other nobles. If they were to err, they must take responsibility for their mistakes, unlike the (democratic) state, whose judgments cannot be contested, even if erroneous. However, disputes must ultimately be resolved, as one can imagine two parties constantly resorting to various noble courts to resolve their conflict until one of them stops and accepts the judgment. Hence, the concept of a king arises, who serves as a noble amongst nobles and the final arbitrator of the law. It is important to note that in this society, the king has no extra privileges compared to others. He must abide by the prevailing universal law like everyone else, cannot establish new laws on a whim, and has no special rights to levy taxes or confiscate land. Every individual is a king on their own property and enjoys equal privileges in society. Kings are not born into their position but become kings through acceptance and can be replaced if required.